Here is some excellent advice on marketing your Gite in France - what not to do and what to do. Full of excellent advice ....

Those of you with properties in France, I would guess have a corner of your main house with things there to take to France next time we go – that’s fine, provided that those things add something to the property. But beware of simply taking everything the family no longer needs such that your holiday home takes on the atmosphere of a car boot stall. We know one holiday home whose kitchen cupboard contained 70 (yes, SEVENTY) glasses of all sizes, shapes and patterns. The house slept six.

So go for minimalist – think ease of cleaning (more of the caretaking, later) and appropriate – and if that means searching UK chain stores for some of their French inspired furniture and nick knacks, well we won’t tell if you don’t. The days of being able to get away with shabby chic are over and contents need to reflect what the guests want and even if that means providing some things you don’t personally approve of.

When choosing a property and leafing through brochures or browsing internet sites, the lack of an amenity the family prefers to have helps refine the decision process – so no matter how lovely the holiday home, how blue the pool, if UK TV makes the difference then a property without it would go on the “no” pile without further ado. Equally lack of dishwasher makes the difference for some people. If we had to choose between the facilities of a dishwasher OR washing machine, we would provide a dishwasher – not a lot of owners understand that!

Keep it simple – you don’t need to agonise over colours, lovely pale walls give that “Provençal” feel to a French home, set off the contents a treat and can be quickly refreshed when required. How ever many the property sleeps, then allow that number plus two for china and glasses. When purchasing them, try and buy more at that moment and keep them locked away for use after the (inevitable) breakages thus extending the lifespan of your matching sets, which look ten times better than a motley collection of various colours, shapes and sizes.

The difference to the “wow” factor you are aiming for when your guests arrive is made up of attention to detail like that …

Bedding needs to echo the simple elegance you are aiming for in the rest of the house, but another bit of attention to detail – no need to push the boat out with top quality 100% cotton which your caretaker will swear over as they attempt to iron and which will never be really “crease free.” So poly cotton minimum iron is fine, but again, neutral pattern if any pattern at all, NOT hand me downs from the family well used already and with three sets per bed to allow time for washing and ironing (yes, it does rain in France sometimes). Another budget saving tip – don’t supply towels – difficult to keep fluffy and pristine, they may get misused and really most people expect to bring their own. Pillows – need not be expensive, but certainly should be replaced each season to keep them fresh. And don’t forget mattress covers - with a spare.

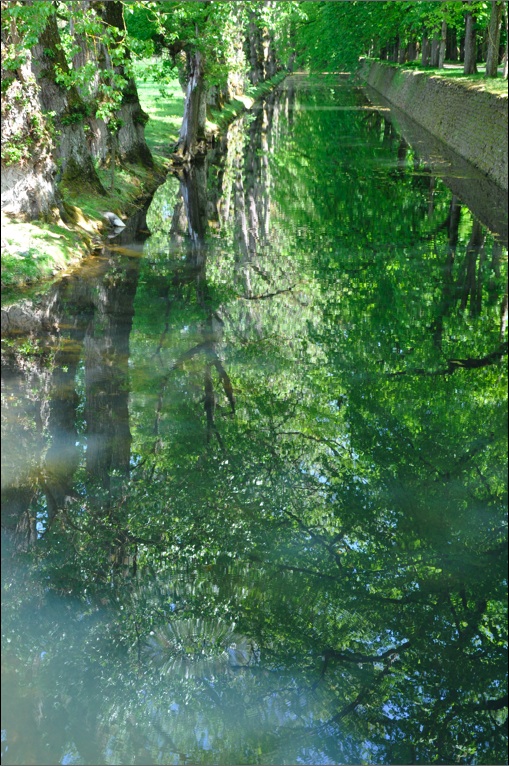

The grounds and garden should continue the simple but good theme and your local caretaker can help enormously here. You need a reliable local presence all year round caretaking your property, and they should really come to the fore if you are aiming to let the property for holidays. The garden planting can aim to present the right external atmosphere just as much as appropriate contents do that on the inside, and of course it is the exterior which the guests will see first on arrival. So, no fussy hanging baskets which can quickly be tired if they don’t receive frequent watering, but again appropriate plants and if they can give that “Mediterranean feel” so much the better, with lavenders, box, bay trees - classic French chic appeal with the effort in their choice rather than their upkeep!

Do you need your caretakers to meet and greet your guests? Not necessarily, you can provide a key safe on the exterior and give your guests the code when they pay the final balance for their holiday. Taking the place of a personal welcome should be a note from the caretakers propped up perhaps on a bottle of wine to welcome the guests, and that together with a well put together housekeeping brochure for the property can give the same “welcome” feeling: the most important thing is to include in the file of how it all works, the contact details of your local caretaker in time of need. Once again, time and effort on the housekeeping file can save you money – how to re-set the

boiler when it trips out may save you the cost of your caretaker needing to turn out in person.

So – your property is well presented, the garden is spruce and reliable local caretaking is in place - but you need to tell the world it is available! Some of the preparations you have made may be such that you advertise the property BEFORE the garden or the contents are completely finished, in which case you must ensure that what you promise in your advertising really IS in place by the time your guests arrive. The only surprises the guests want is to discover that the photographs did not do the property justice rather than that they mislead!

Appropriately marketing the property means ensuring that it does what it says on the tin – that what you advertise is what it provides. It can be a simple small cottage in rural France which is marketed to appeal as a French idyll and as long as it is warm and cosy and even cute then it will fulfil its’ promise and provide the holiday your guests hoped for, with personal recommendations for your future bookings. Agonising over what you provide goes with the territory, when you remember that holidays are dreams for people working hard all year, but presenting the property to its true potential needs to stop short of misleading.

We once were asked to look after a property whose advertising promised an “open terrace” for relaxing barbecues. When we tried to match up the photographs on the website with the property itself, we realised the road outside the front door had been air brushed and it was being described as that open terrace. We politely refused to handle the property!

The flip-side of this is to choreograph your photographs to ensure they do show off the property to its best. Make up the beds with your carefully chosen bed linen, dress the dining room table with attractive china and a bottle of wine, put flowers on the sideboard – and make sure you have photographs of the garden at its summer best. It’s amazing how many people start organising their advertising in October and only then realise they have no photographs of the garden in summer...

Price your property so that it is good value, and maybe deliberately have a changeover day which is NOT a Saturday to give guests a chance of arranging their travel at much cheaper off peak times – we have properties on our books with changeovers ranging from a Thursday through to a Monday and none of them suffer as a result, quite the reverse in fact, not surprising when you realise that a ferry fare on a Thursday night can be several hundred pounds cheaper than on a Friday or Saturday.

Spread your advertising over some internet sites – start with us on Guide2MidiPyrenees, it’s great value for the exposure you have - and then start thinking outside the box .. handouts in your own local home area with perhaps a discount for people you have contact with .. the local Health Centre, the dentist, local solicitors .. the intranet where you work .. see what I mean?

Sally Stone

CEO Les Bons Voisins